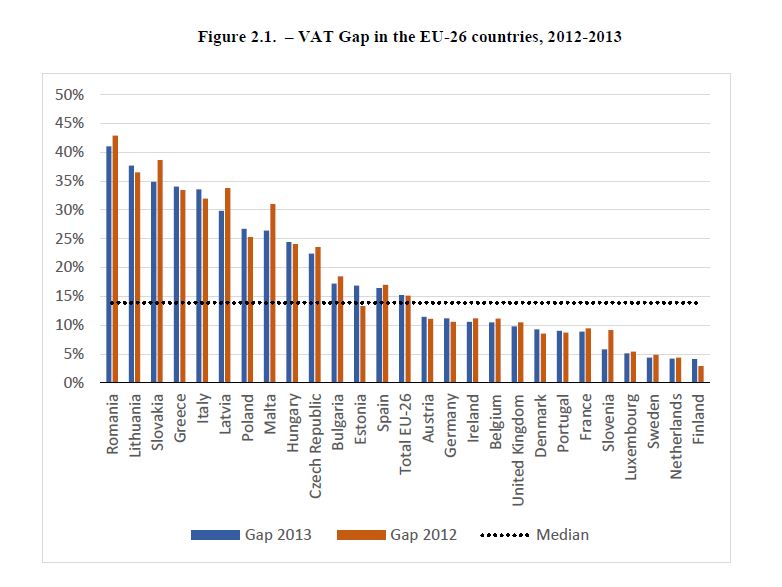

The VAT gap in the Central and Eastern European countries (as a percent... | Download Scientific Diagram

Collection Dilemmas and Performance Measures of the Value-Added Tax in Germany and Poland in: International Journal of Management and Economics Volume 54 Issue 2 (2018)

Czech Republic Says EU Action Needed On VAT Gap | Onestopbrokers – Forex, Law, Accounting & Market News

European Commission 🇪🇺 on Twitter: "EU countries lost almost €150 billion in #VAT revenues in 2016, according to our new study. They have been reducing this 'VAT Gap', but a substantial improvement

PLOS ONE: Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach

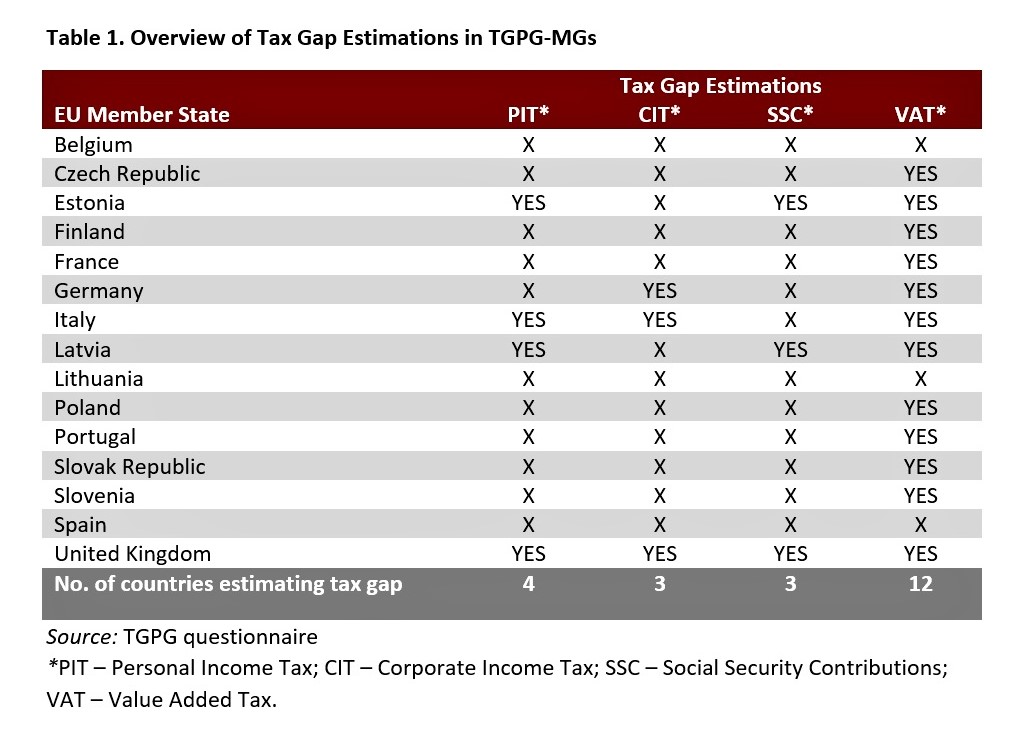

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research