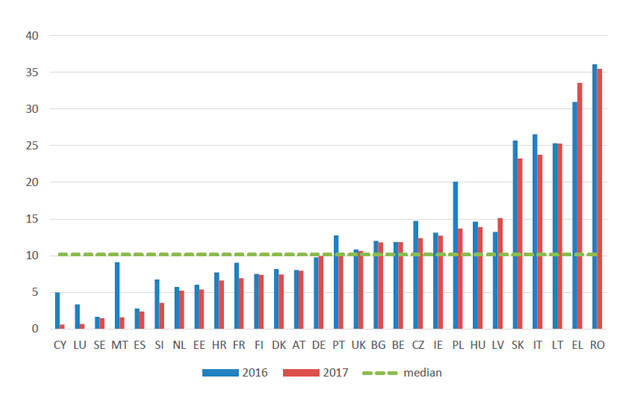

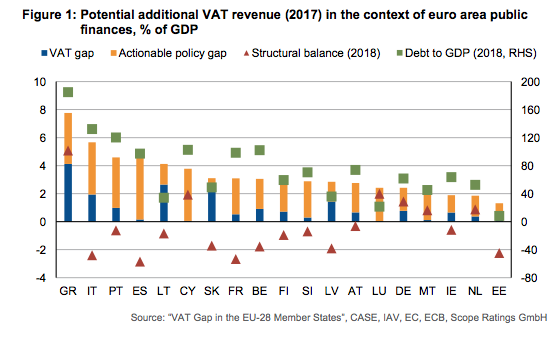

EU Tax & Customs 🇪🇺 on Twitter: "EU Member States still losing over €137 billion in revenues according to new figures. Full VAT Gap report: https://t.co/LLdVPzqUTB #VATGap… https://t.co/jNC7gNj5sU"

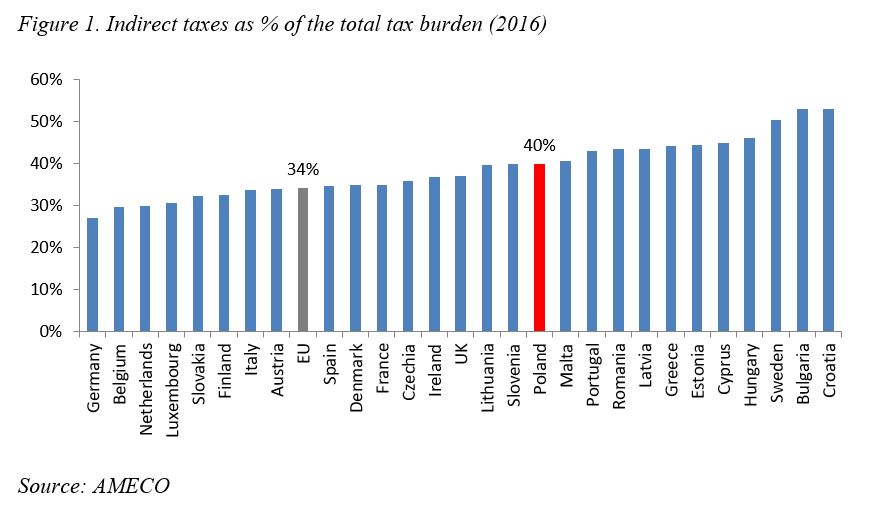

Mind the VAT gap: more effective consumption-tax collection could improve Eurozone's public finances

19. Netherlands: VAT Revenue, VTTL, Composition of VTTL, and VAT Gap,... | Download Scientific Diagram